Renters Insurance in and around Long Beach

Long Beach renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

There’s No Place Like Home

Renting a home comes with plenty of worries. You want to make sure what you own is protected in the event of some unexpected trouble or loss. And you also need liability protection for friends or visitors who might hurt themselves on your property. State Farm Agent Erica Ruiz is ready to help you handle the unexpected with high-quality coverage for your renters insurance needs. Such attentive service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Erica Ruiz can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Long Beach renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Why Renters In Long Beach Choose State Farm

When the unexpected break-in happens to your rented home or apartment, often it affects your personal belongings, such as a TV, a coffee maker or a tablet. That's where your renters insurance comes in. State Farm agent Erica Ruiz has the knowledge needed to help you choose the right policy so that you can protect your belongings.

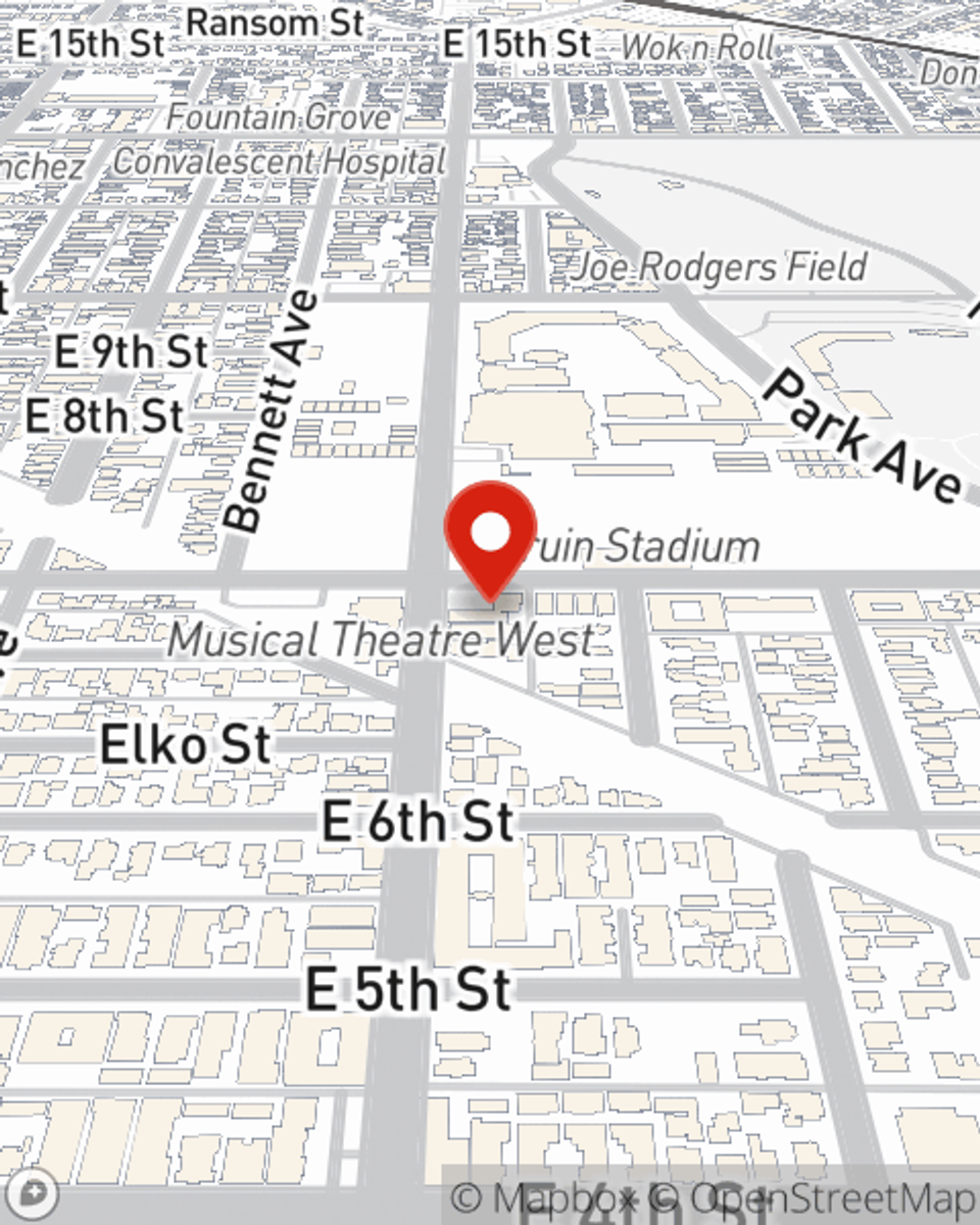

Renters of Long Beach, State Farm is here for all your insurance needs. Visit agent Erica Ruiz's office to get started on choosing the right policy for your rented apartment.

Have More Questions About Renters Insurance?

Call Erica at (562) 375-0037 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.